Meaning Of Efficient Frontier

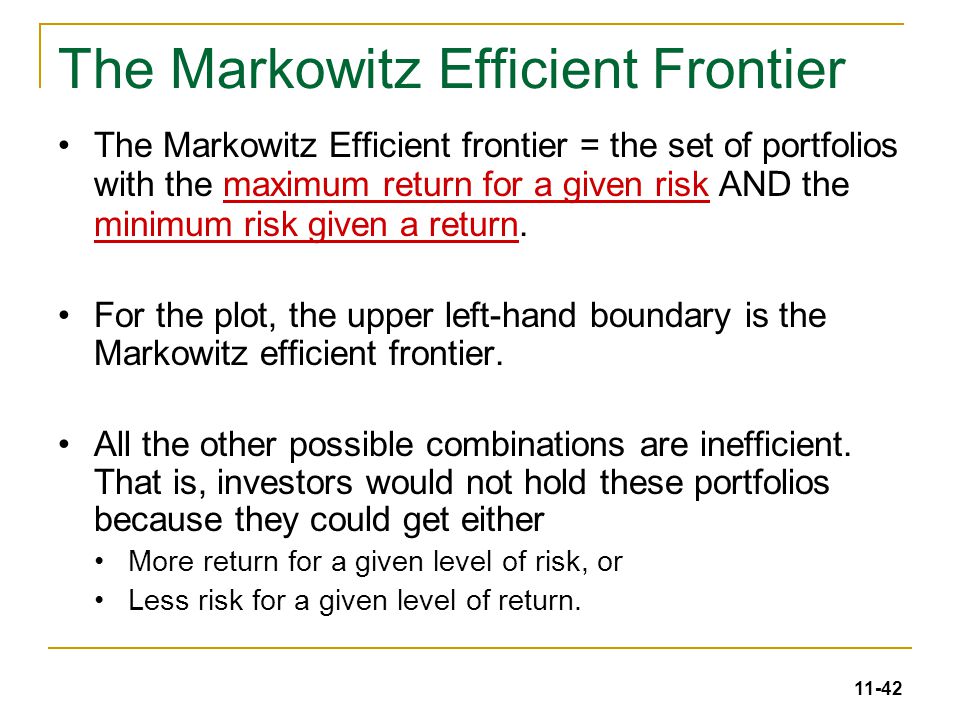

The efficient frontier also known as the portfolio frontier is a set of ideal or optimal portfolios that are expected to give the highest return for a minimal level of return.

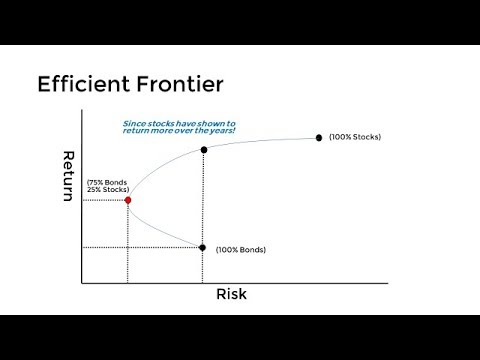

Meaning of efficient frontier. An efficient set of portfolios is represented as a line on a graph with risk as the x axis and expected return as the y axis. The efficient frontier represents the best possible returns that one can expect considering the level of volatility that a particular inv. Markowitz efficient portfolio homogeneous expectations assumption.

Information and translations of efficient frontier in the most comprehensive dictionary definitions resource on the web. This frontier is formed by plotting the expected return on the y axis and the standard deviation as a measure of risk on the x axis. What does efficient frontier mean.

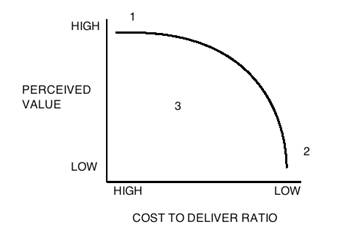

When markowitz introduced the efficient frontier it was groundbreaking in many respects. Efficient frontier is a concept in operations that states that a company is efficient if it has the highest perceived value for a given cost to deliver value of the company. Why does efficient frontier matter.

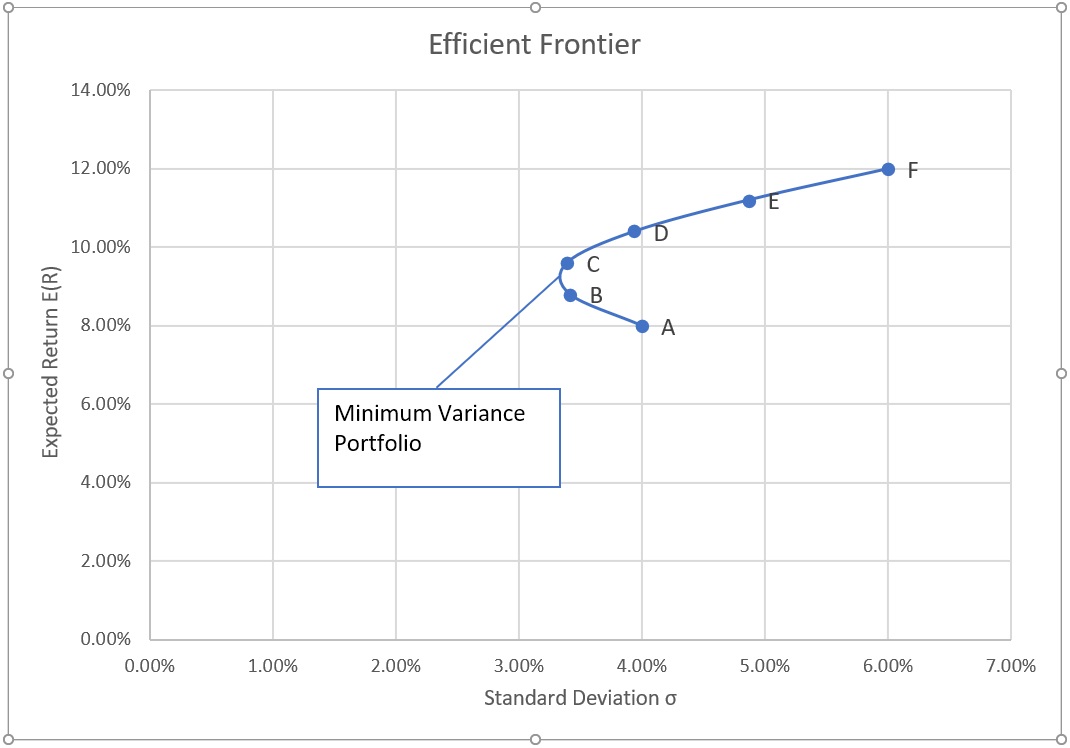

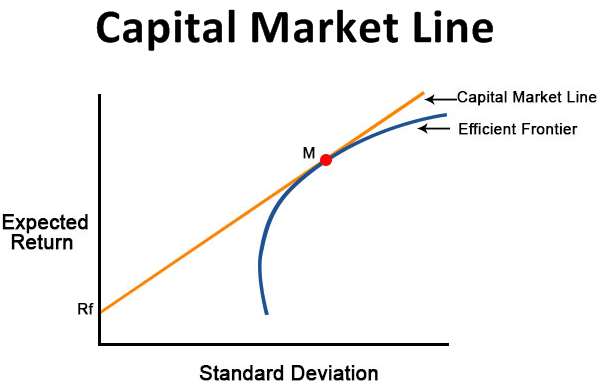

The efficient frontier is the set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Thus it indicates the operational efficiency of the company considering whether the company is a low cost provider or a high cost provider and how should it position. First off let us understand the true essence and meaning of the efficient frontier theory.

The efficient frontier is curved because there is a diminishing marginal return to risk. This representation is the markowitz efficient frontier. The choice of any portfolio on the efficient frontier depends on the investor s risk preferences.

Meaning of efficient frontier. In modern portfolio theory the efficient frontier or portfolio frontier is an investment portfolio which occupies the efficient parts of the risk return spectrum formally it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return but with the same standard deviation of return i e the risk.

.jpg)

/EfficientFrontier-CML-JPEG-6cef956488a3436c9ca019451b9e5905.jpg)

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)