Meaning Of Efficient Market

:max_bytes(150000):strip_icc()/thinkstockphotos_493208894-5bfc2b9746e0fb0051bde2b8.jpg)

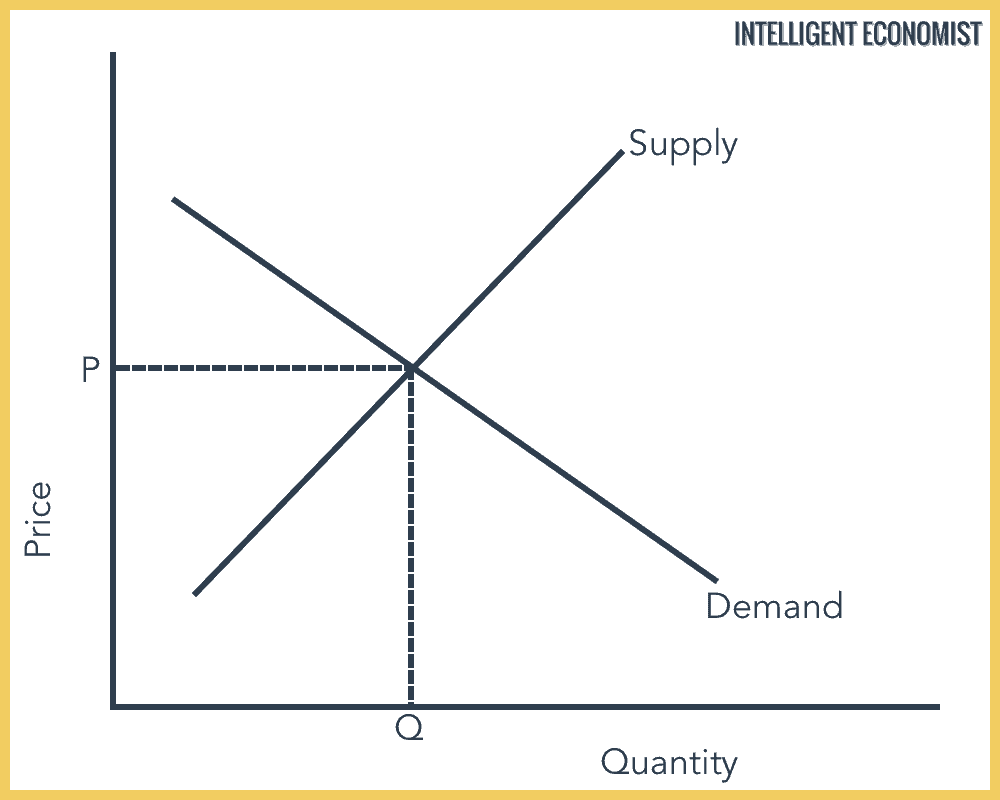

Efficient market is one where the market price is an unbiased estimate of the true value of the investment.

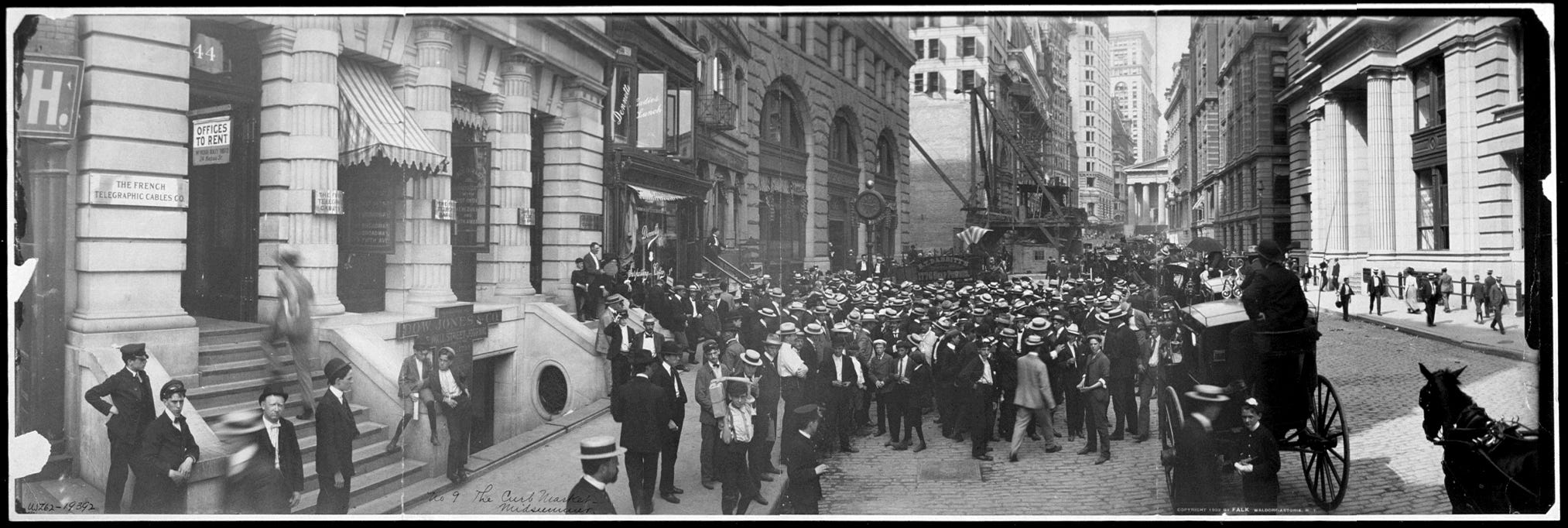

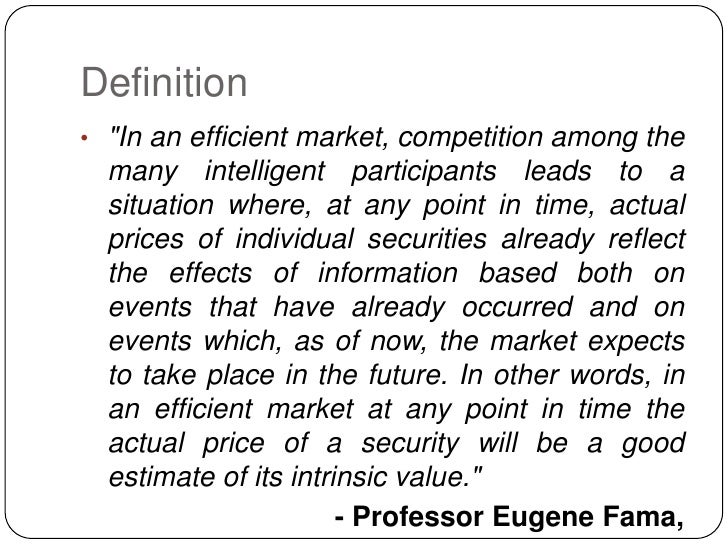

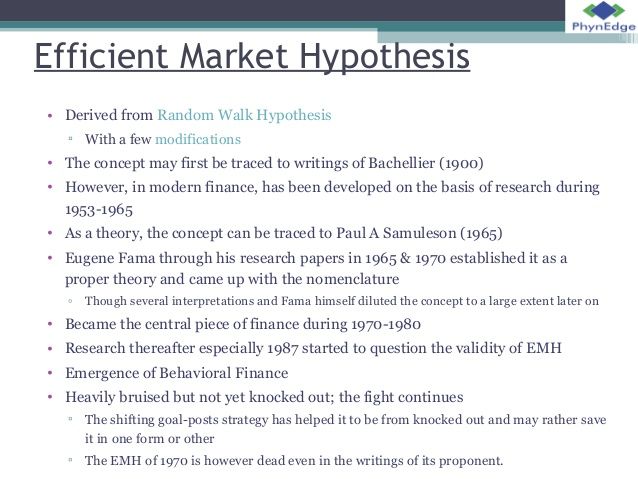

Meaning of efficient market. The question of whether the stock market is efficient is critical to inform our investment decisions. The efficient market hypothesis emh is an investment theory launched by eugene fama which holds that investors who buy securities at efficient prices should be provided with accurate information and should receive a rate of return that implicitly includes the perceived risk of the security. The aspirin count theory is a lagging indicator and actually hasn t been formally.

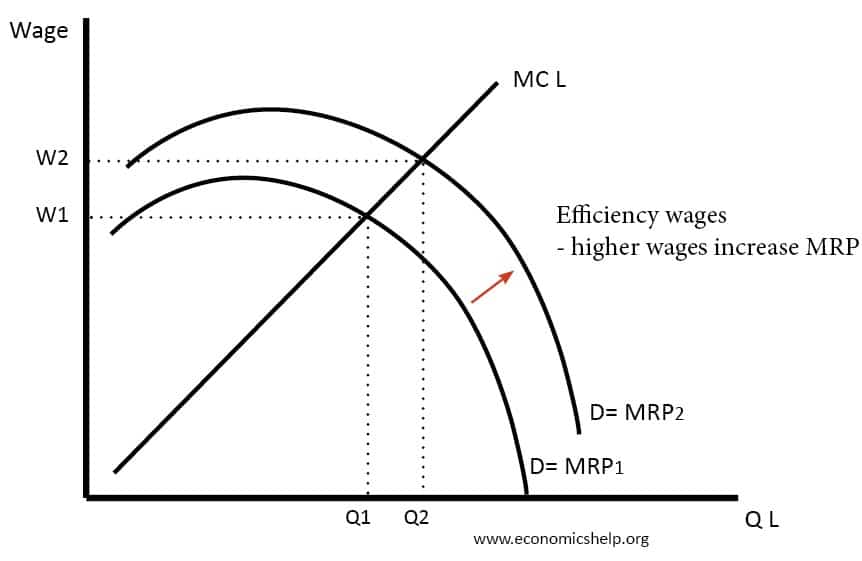

Implicit in this derivation are several key concepts a market efficiency does not require that the market price be equal to true value at every point in time. This is the case with securities traded on the major us stock markets. An efficient market is one in which the prices of the assets traded in it reflect at all times the information available on the market.

That means the price of a security is a clear indication of its value at the time it is. When the information is released the different market agents analyze it and use it to make decisions. In a market situation of this type anyone who is involved in trading activity is able to make use of the information to assess the past performance of the security in question.

Strong form efficiency is a type of market efficiency that states that all market information public or private is accounted for in a stock price. A market theory that states stock prices and aspirin production are inversely related. When the information that investors need to make investment decisions is widely available thoroughly analyzed and regularly used the result is an efficient market.

Financial asset prices react strongly to market information. Market efficiency definition and tests. The efficient market hypothesis emh is a hypothesis in financial economics that states that asset prices reflect all available information.

More informationally efficient market definition. So this information is incorporated into the price as it arrives. Efficient markets are markets in which the flow of relevant information regarding investment options is easily accessed and reliable.

:max_bytes(150000):strip_icc()/world-map-marketing-megaphone-man-job-loudspeaker-1447727-pxhere.com-96344108f9cd411980340c886914579e.jpg)

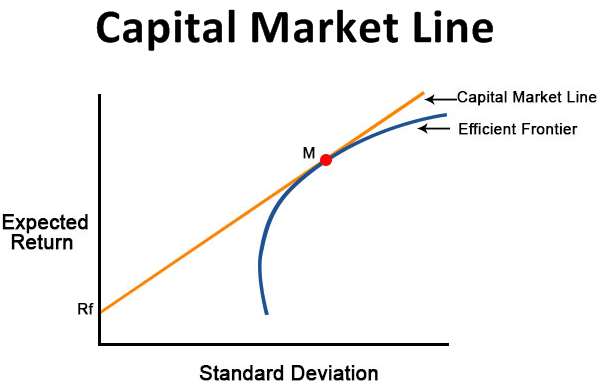

/EfficientFrontier-CML-JPEG-6cef956488a3436c9ca019451b9e5905.jpg)