Meaning Of Efficient Hypothesis

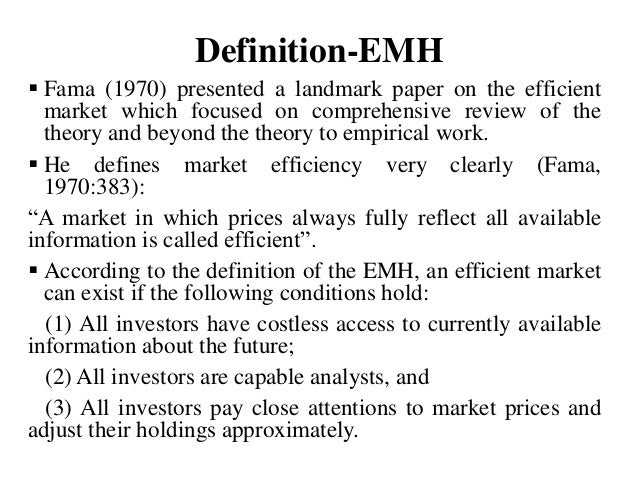

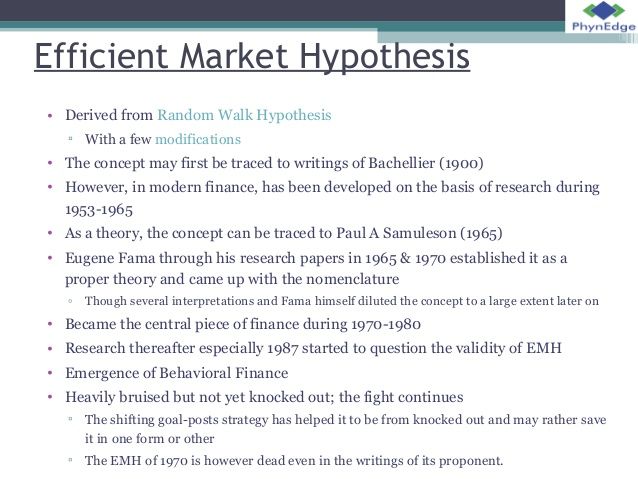

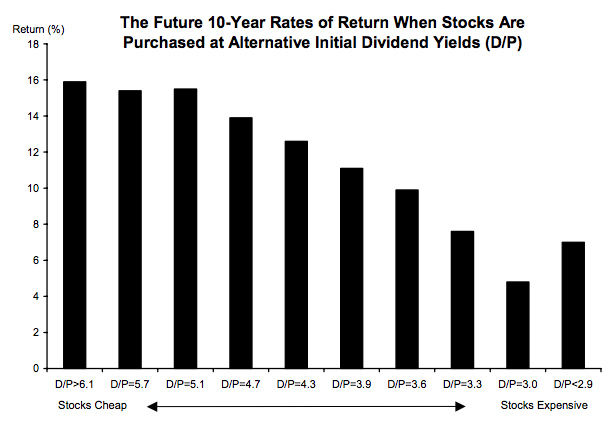

The efficient market hypothesis emh is a hypothesis in financial economics that states that asset prices reflect all available information.

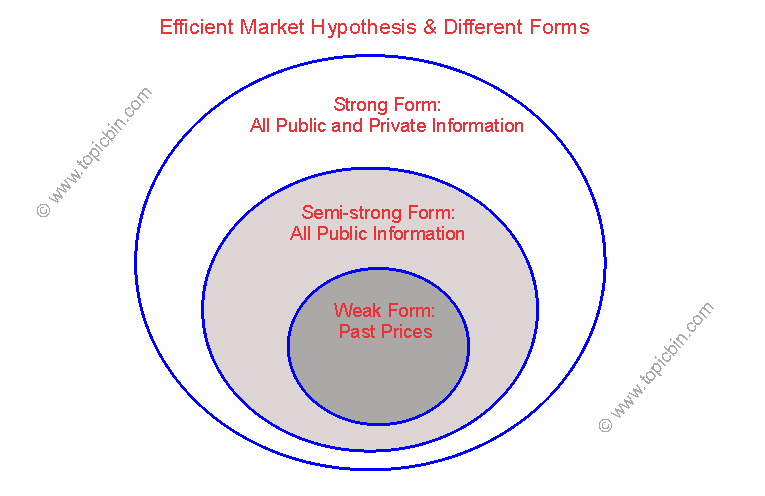

Meaning of efficient hypothesis. Weak semi strong and strong. In other words an investor should not expect to earn an abnormal return above the market return through either technical analysis or fundamental. In consequence of this one cannot consistently achieve returns in excess of average market returns on a risk adjusted basis given the information available at the time the investment is made.

Moreover under an efficient market random events are entirely acceptable. A market theory that states stock prices and aspirin production are inversely related. There are three major versions of the hypothesis.

A direct implication is that it is impossible to beat the market consistently on a risk adjusted basis since market prices should only react to new information. Efficient market hypothesis definition. In finance the efficient market hypothesis emh asserts that financial markets are informationally efficient.

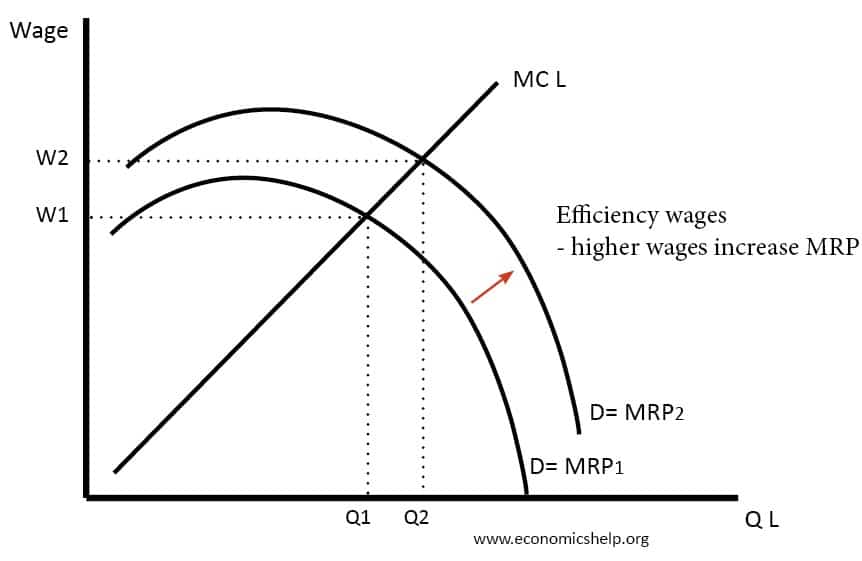

The efficient market hypothesis emh is an investment theory launched by eugene fama which holds that investors who buy securities at efficient prices should be provided with accurate information and should receive a rate of return that implicitly includes the perceived risk of the security. An efficient market shows all the market information available at a period of time to investors or other market participants. The efficient hypothesis however doesn t give a strict definition of how much time prices need to revert to fair value.

:max_bytes(150000):strip_icc()/world-map-marketing-megaphone-man-job-loudspeaker-1447727-pxhere.com-96344108f9cd411980340c886914579e.jpg)

:max_bytes(150000):strip_icc()/GettyImages-507841210-d6adb6f951bf444888e561b153b9c40c.jpg)